Weekly Trade Journal (26th May 2025 - 30th May 2025 / CW22-2025)

How was the week for me...?

This is my weekly trade journal where I record what trades I took, how my trades went on, closed trades, lessons I learnt from market.

Link to last week’s Journal is Here

Market continued to be flat for the week swing indicators were coming down slowly. Took 4 more positions this week, it was mixed bag few worked and few didn’t. PF was up 0.96%.

Closed Positions

No closed positions this week.

Open Positions

1. ERIS

1st Buy Price: 1519.00, 1st Buy Date: 21st May,

Initial SL: 1380.00, Initial Size: 10.25%, Initial Risk: 0.93%,

Avg Price: 1519.00, TSL: 1483.00, Revised Size: ______%, Revised Risk: 0.24%

Set up: Positive reaction to earnings, made a deep low next day bought as it recovered from deep intraday low. Good RS stock trading near ATH. Coming out of a long consolidation pattern.

Objective: Follow the price trend, trail with price structure lets see.

Price made a new high this week and having a PB, looks normal. Showing good strength in weak market good signs.

The day I bought this it made a intraday low below my stop, luckily survived.

Chart looks ripe for a PB, following 20dema as trailing stop now. Accept the risk dont close premature, chart is showing real strength worth taking risk.

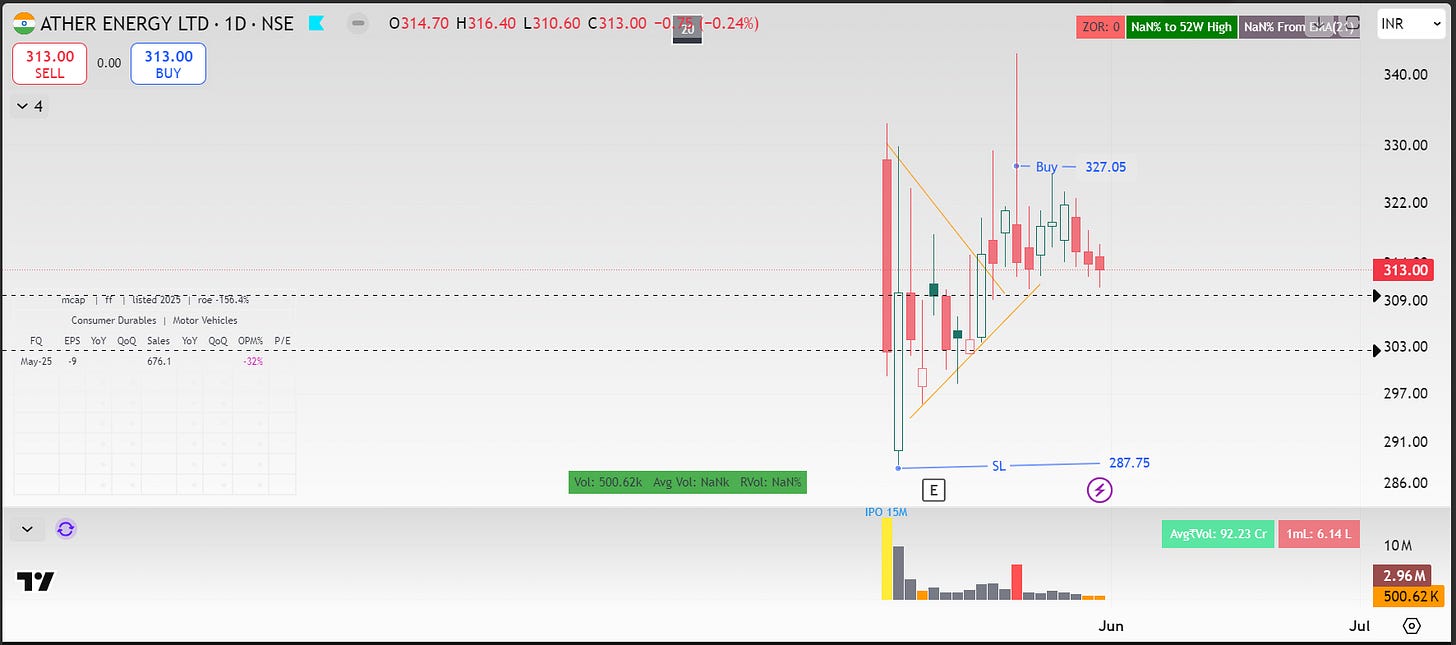

2. AETHERENERG

1st Buy Price: 327.00, 1st Buy Date: 21st May,

Initial SL: 287.00, Initial Size: 6.54%, Initial Risk: 0.80%,

Avg Price: 327.00, TSL: _____, Revised Size: ______%, Revised Risk: _____%

Set up: Recent IPO, bought as it came out of a TL resistance and crossed IPO high, but it stalled back the same day.

Objective: IPO stock can perform big, lets see following IPO low as stop. Relatively less size will add on later.

The break out turned into a squat, made a fair attempt to move up but turned down again.

So far doing nothing trading below my entry point, IPO low is my stop but dynamically I will exit if the structure changes before that.

Market is getting weak worth giving some room for IPO bets like this.

3. ASTRAL

1st Buy Price: 1440.00, 1st Buy Date: 22nd May,

Initial SL: 1345.00, Initial Size: 13.00%, Initial Risk: 0.85%,

Avg Price: 1440.00, TSL: 1370.00, Revised Size: ______%, Revised Risk: 0.63%

Set up: It was in a down trend and look like took support from a monthly Drop Base Rally (DBR) demand zone. Made a HH after earnings. Look like a good timed buy for now.

Objective: Reversal bet will try to hold on with a liberal stop lets see.

Made a fair move to start the week and became extended. Pull back going on it can continue till 20dema.

Trailing with 20dema for now will use it dynamically to exit at violation.

4. DELHIVERY

1st Buy Price: 361.70, 1st Buy Date: 26th May,

Initial SL: 339.00, Initial Size: 6.00%, Initial Risk: 0.37%,

Avg Price: 361.70, TSL: _______, Revised Size: ______%, Revised Risk: _____%

Set up: After earnings price was up with highest ever volumes, and 3 bars inside earnings candle. Bought as it came above the narrow zone.

Objective: Bought in anticipation of some delayed EP reaction but not happened so far.

Made an attempt to move up but squatted, position size is relatively small and risk also less. Plan was to add more but so far no strength.

Need to accept the risk, after good earnings reaction and strong volumes worth to take the risk.

5. PTC

1st Buy Price: 188.75, 1st Buy Date: 28th May,

Initial SL: 171.00, Initial Size: 10.00%, Initial Risk: 0.97%,

Avg Price: 188.75, TSL: _______, Revised Size: ______%, Revised Risk: _____%

Set up: Price is in uptrend for 5 months and a base formation. Bought when it came out of 2 tight candles. But turned into a immediate squat.

Objective: Thinking of long term holding, bought with deeper stop but it had other plans. A tight stop would have been a better option.

Anticipated break out not happened, price came down hard, I stuck to my plan held on to it so far.

Nothing much to do now, need to accept the risk follow gap low as stop.

6. STAR

1st Buy Price: 744.50, 1st Buy Date: 29th May,

Initial SL: 203.00, Initial Size: 10.00%, Initial Risk: 0.77%,

Avg Price: 744.50, TSL: 707.00, Revised Size: ______%, Revised Risk: 0.50%

Set up: Price forming a long consolidation base, positive reaction to earnings, bought as it crossed the earnings pivot.

Objective: Crossed ATH with large base pharma and healthcare sector looking good too. Can be a long term bet lets see how price reacts.

Made a good move, need to sit through Pull backs now. SL moved a little higher.

Follow the price that’s the plan lets see.

7. RBLBANK

1st Buy Price: 212.50, 1st Buy Date: 29th May,

Initial SL: 203.00, Initial Size: 10.00%, Initial Risk: 0.44%,

Avg Price: 212.50, TSL: ______, Revised Size: ______%, Revised Risk: _____%

Set up: Price in uptrend since March, respecting 20dema bought at PB reaction to20dema.

Objective: In early uptrend, traded this before lets see hold as the price guides.

Made a fair move but not followed through, market pressure + supply zones.

Need a good move to decide what to do, till the keep stop in system accept the risk.

Currently I am 65.75% investedAll risks and PnL’s mentioned here are in terms of overall PF %age.Portfolio updates and stats

Portfolio was up +0.96% for the week.

Current open risk at PF level is 3.73%. Last week it was 2.59%. (More than double money invested compare to last week, risk managed well)

Portfolio is down 9.74% from last peak (Last peak was on 20th Sep 2024). (Goal was not to have a draw down of >9% but failed) Some how after long time DD reaching near permissible levels, need discipline and a little luck from market).

Expected drawdown at present is 15.71% from last peak (20th Sep 2024), Will wait this to reduce to add new positions.

Learnings

Market swing slowly continued to come down, but some stocks/sectors did well.

I followed a deeper stop in PFC which immediately turned out against my anticipation, this is market telling me to just stick to what’s my system.

Its important to be in trades in leading sectors, 2 Pharma stocks ERIS & STAR lead the PF signifies the importance to stock selection in leading industries.

Missed few trades in fertilizers and agrochem sector this week, need to scan market regularly and be aware of what’s going on.

Plans for the week ahead.

Currently we are in a slow down swing within an up wave and divergences between large and small caps is still present. Caution ahead.

But stock/sector specific moves are present, its good to have a big picture bias but be objective in taking trades in leading names. I will continue to hold on to my existing positions follow the price action.

I am 65% invested at present, and drawdown in near permissible levels, need to operate with cautiously and must bring the DD below 9% next week. Risk management comes first now.

We are in Mid of down swing but this swing is coming down very slow that gives less chance to take short trades. Need to be ready for that as well keep the options open. Down swing may accelerate from here.

In big picture market didn’t do anything for 2 weeks now, divergence with large & Mid/small caps still present. (more on this in market outlook post)

At the same time dont forget we are still in the mid of bear market, need to analyze the breadth and build and objective situational awareness about Big Picture. (more on this in market outlook post)

That is all for this week, see you next week. GOOD LUCK.

Thanks

Shangren Panda 🐼

Disclaimer: This post is my own trading journal and not a financial guide or advice. I am not a qualified financial advisor nor an influencer, Please do your due diligence and contact your financial advisor before investing in capital markets.