Market Outlook for the week 2nd June to 6th June 2025 / CW22-2025

Weekly analysis of general market environment.

This post is an attempt to have an idea about general market health and to forecast what possibly can happen for the next week ahead. This is 50th post in this series. Check the last week outlook here..

As a technical analyst “I anticipate but confirm. I wish but only react.”

No holidays next week.

Global Markets

US market was flat to up this week, but weekly bar was kind of consolidation indecisive if we see it technically.

NASDAQ up 2.03%, S&P up 1.88%, DJI up 1.60%, RSP up 1.20%, RUSSEL2000 up 1.19% this week. VIX came down 16%, last week it was up 29%..

European indices also flat to up less than 1% except DAX it was up 1.56%.

Dollar Index (DXY) stayed flat, currently trading at important levels, a break down from here is a good sign for emerging markets.

0 distribution day added this week and 0 expired. Now count is 4 in 30 days in Russel 2000. 2 will expire next week.

Russel 2000 is trading around 21dema for 3 weeks now. Forming a base, keeping a close watch which way it will go.

Let see how our markets look like for now

General Market

Are we in a long-term Up trend or Down trend (The Trend)?

Where are we located in the trend (start, mid, extended)? How old the trend is?

We are in mid of down trend and in 2nd counter wave up within the down trend. The counter wave is extended now, a new LL from here on is a beginning of fresh 3rd wave down move.

We are in the Mid of down trend, which is 35-36 weeks old.

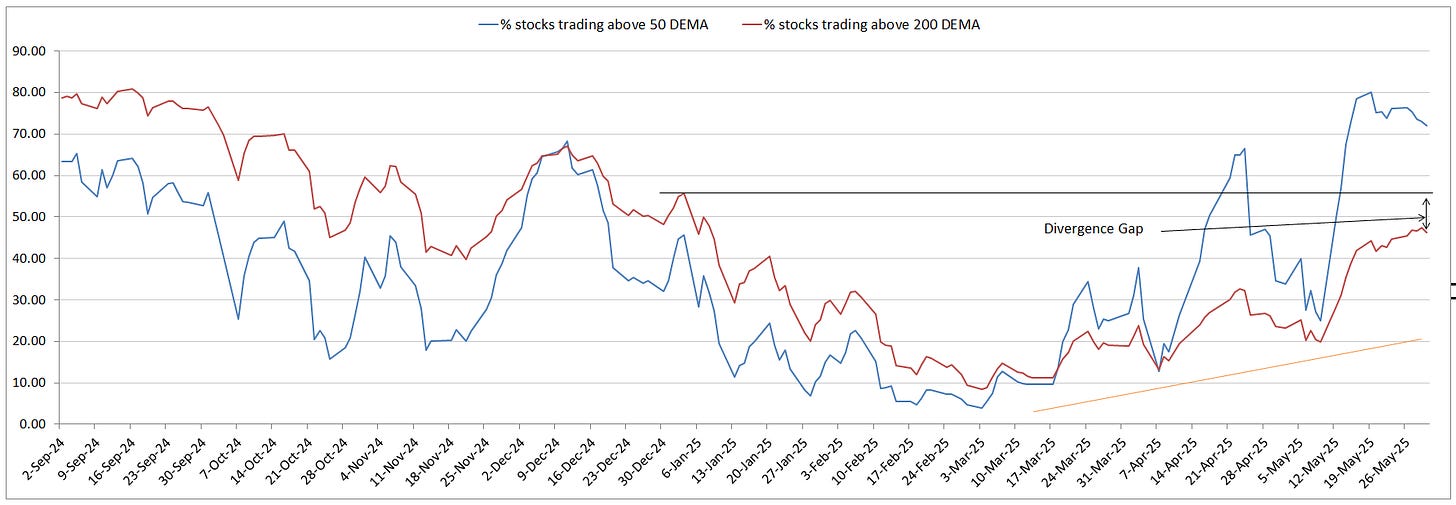

A down trend or correction phase can last for 60 to 72 weeks (15-18 months) in general. With 3 or 4 down waves. What market breadth Trend indicators showing? (Within 15% & 30% of 52W-H/L range count, stocks above 50 & 200dema counts etc..,)

Trend indicators continued to show -ve divergence with indices. Also started to show an early signal of going down with indices consolidating. Time to be cautious.

Long term trend indicators are still in low levels confirms the down trend.

Is the Trend in transformation phase?

No trend transformation signs at present.

Rather there are signs of the present counter up wave ending. Check the divergences of trend indicators mentioned in below chart, Though the broader spread index was up this week outperforming CNX500 breadth came down,, this signaling the end of extended counter up wave.

The -ve divergence between large caps vs mid & small cap we were observing for last couple of weeks still exists even after this week’s outperformance. Also this week’s up move in Mid & Small caps looks structurally fragile.

1. 1st Wave down -- 24th Sep to 18th Nov -- 55 days

2. 1st Wave up -- 18th Nov to 12th Dec -- 24 days

3. 2nd Wave down -- 12th Dec to 3rd Mar -- 81 days

4. 2nd Wave up -- 3rd Mar to till date -- 88 days (early signals of ending)

Formation of LL, LH in the above chart will confirm the next down wave, till then need to just follow the chart.Are we in Up/Down/Flat-swing within the trend (The Swing)? Where are we located in the swing (start, mid, extended)? How old the swing is?

We are now in a slow down swing which started on 20th May. But this is not visible on charts, all key indices are positive but swing indicators telling the opposite.

Mid Down Swing, which is 9 days old.

What market breadth Swing indicators showing? (ADV/DEC ratio, New 52W-H/L count, UP/Down >4% in a day count, up 15%+ in 5days count, 10 & 20dema breadth counts etc..,)

Swing indicators are behaving opposite to indices charts, they were coming down in slow pace but for last 2-3 days this pace is accelerating. Need to be cautious.

What types of stocks are moving (largecap, mid & smallcap, growth, junk etc)?

Mixed bag, sector specific moves happening, mostly small & micro caps moving.

Notable observations in Sectoral indices and Thematic industries?

Many sectors started to weakening and few moved to down trend on charts. Not so good signs ahead.

On RRG charts Pharma, Healthcare, FMCG, Banks and Financials now moving from lagging to improving quadrants, (Pharma, Healthcare are in short term rotations and others are in long term rotations).

On RRG leading sectors AUTO and IT entered into weakening quadrant.

Particularly FMCG, Pvt Banks and Financials are where the opportunity lies as per monthly period RRG.

Below thematic industries out performed the broader market. Specialty Chemicals, Aerospace & defense, Auto Ancillaries, Electrical Power Equipment, Industrial Products are worth following which were leading last week too.

Are the breakouts working in last few trades?

It was a mixed bag. Very selective names worked but many squatted.

Any event which can affect market coming week?

No particular scheduled events which can affect, but market looks vulnerable for any small news.

Summary

Trend: Mid Down,

Wave: Late 2nd counter Up,

Swing: Mid Down Swing,

What possibly can happen next week? and what to do?

We are in mid down swing which was slow but looking like accelerating. This is a concern, when swing indicators are in lower half they are prone to fall faster.

Counter up wave is still going on but trend indicators are showing serious red flags in terms of -ve divergence. Adds more weight to cautious stance.

If the above 2 points turns out to be true, then we may have a fresh 3rd wave down. That can be both long and deep.

Marking current swing confidence as 0.00, just hold on to existing positions and better tighten the trailing stop. Even a minor weakness signs its better to close.

Its time look for short setups but dont take more than 1/4th of normal risk and limit overall risk to 1% at PF levels at any time.

Long term trend is down which is not changed, so no positional bets whatever I will be risking will only be a swing trades with RR game.

Over all I am anticipating a down move for next week, I can be wrong if market continues to go up but that will not be a big issue, we all know bull market do provide chances to get in.

Thanks & That’s all for the week, Good luck. I will update in comments if any interesting development happens.

Disclaimer: This post is for my own record and not a financial guide or advice. I am not a qualified financial advisor nor an influencer, Please do your due diligence and contact your financial advisor before investing in capital markets.

Thanks for sharing 🙏🏽